Welcome to the dynamic and intriguing world of Bitcoin investment. In today’s rapidly evolving financial landscape, Bitcoin has emerged as more than just a digital currency; it’s a symbol of the shift towards a digital economy. This introduction serves as your gateway to understanding and navigating the realm of Bitcoin, a realm where traditional financial concepts are being redefined and where the future of money is being rewritten.

Bitcoin’s journey from an obscure digital novelty to a recognized investment asset is nothing short of remarkable. It has captivated the interest of investors worldwide, from individual enthusiasts to large institutions, heralding a new era of digital finance. This section will delve into Bitcoin’s rise to prominence, exploring how what was once a niche internet currency has now become a staple in the portfolios of forward-thinking investors.

Our objective is to demystify the process of investing in Bitcoin. This guide is designed to walk you through the essentials of Bitcoin, from understanding its basic principles to developing advanced investment strategies. Whether you’re a seasoned investor or new to the world of cryptocurrencies, this article aims to provide you with the insights and knowledge needed to navigate the Bitcoin investment landscape confidently.

Understanding Bitcoin: The Basics of Digital Currency

What is Bitcoin?: Unraveling the Digital Currency Phenomenon

Bitcoin is a revolutionary digital currency that operates independently of a central bank. It’s a peer-to-peer system where transactions are directly between users and recorded on a blockchain, a decentralized ledger. Understanding Bitcoin begins with recognizing its uniqueness – it’s not just an electronic version of cash, but a reimagining of what currency can be in the digital age: decentralized, secure, and global.

The History of Bitcoin: Tracing the Roots of a Digital Revolution

Bitcoin’s story began in 2009, created by an individual or group under the pseudonym Satoshi Nakamoto. Initially a niche interest among tech enthusiasts, it gradually gained traction as a speculative asset and a means of digital transaction. Its history is marked by milestones – from the first real-world transaction buying pizzas to dramatic price surges, regulatory debates, and growing institutional adoption.

How to Start Investing in Bitcoin

Setting Up for Bitcoin Investment: Laying the Groundwork

Investing in Bitcoin begins with a few essential preparations. First and foremost, you need a digital wallet. This wallet is where you’ll store your Bitcoin securely. There are several types of wallets available, including hardware wallets (like Ledger or Trezor) and software wallets (like Exodus or Electrum). Each type has its security features and conveniences, so choose one that aligns with your needs. Next, select a reputable cryptocurrency exchange where you’ll buy and sell Bitcoin. Look for platforms known for their security, user-friendly interface, and reasonable fees, such as Coinbase, Binance, or Kraken. Ensure your exchange choice aligns with your region’s regulations and offers the necessary support.

Analyzing the Market: Navigating Bitcoin’s Price Movements

Understanding the Bitcoin market is crucial for successful investing. Begin by familiarizing yourself with basic market analysis techniques like reading candlestick charts, understanding order books, and monitoring Bitcoin’s price movements in relation to news events and market trends. Utilize resources like TradingView for chart analysis and CoinMarketCap for price tracking. Keep abreast of news that can impact Bitcoin’s price, such as regulatory changes, technological advancements, or macroeconomic factors.

Investment Strategies: Tailoring Your Bitcoin Approach

Your investment strategy in Bitcoin should reflect your financial goals and risk tolerance. For beginners, a common strategy is ‘buy and hold’, where you buy Bitcoin and hold onto it long-term, regardless of short-term market fluctuations. More experienced investors might engage in ‘trading’, attempting to profit from market volatility. Another strategy is ‘dollar-cost averaging’, where you invest a fixed amount in Bitcoin at regular intervals, reducing the impact of volatility. Each strategy has its pros and cons, so consider your investment horizon and risk appetite before choosing.

Bitcoin’s Financial Market Impact

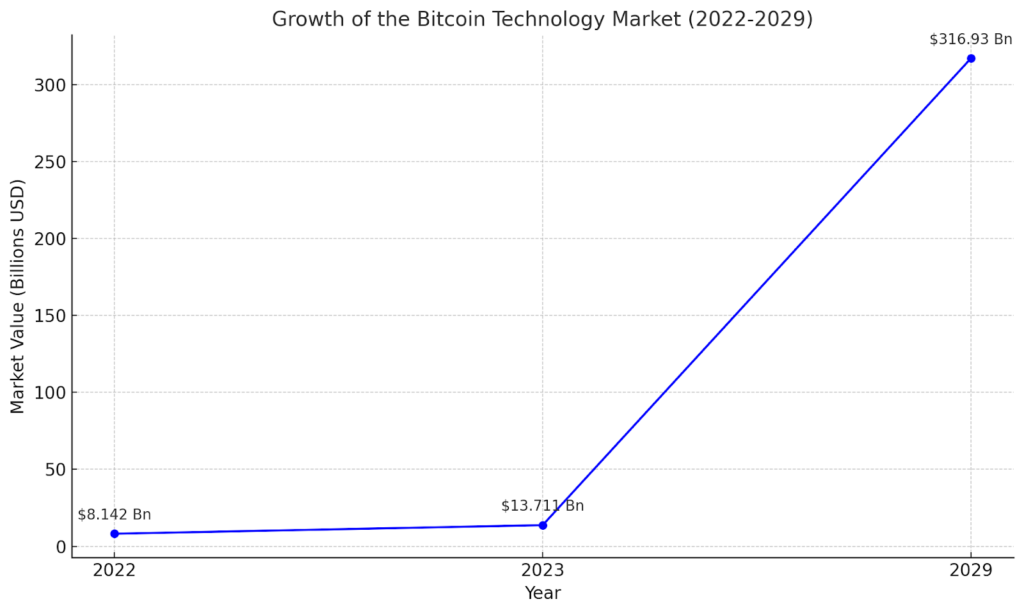

The financial impact of Bitcoin has been substantial and is increasingly evident in the Bitcoin Technology Market’s growth. From a valuation of USD 8.142 billion in 2022, the market is expected to undergo exponential growth, reaching an estimated USD 316.93 billion by 2029. This remarkable expansion, at a CAGR of 68.4%, underscores the rising significance of Bitcoin in the global economic landscape. As Bitcoin continues to evolve and integrate into various sectors, its impact extends beyond just a digital currency, becoming a vital component of the burgeoning digital economy.

Top 5 Factors to Consider Before Buying Bitcoin

Market Volatility: Navigating Bitcoin’s Price Swings

Bitcoin is known for its high volatility. Price swings can occur rapidly, influenced by factors like regulatory news, technological developments, and market sentiment. Before investing, understand that Bitcoin’s price can fluctuate widely, which could affect your investment’s value. Prepare for this volatility by only investing money you can afford to lose and maintaining a long-term perspective.

Security Measures: Protecting Your Bitcoin Investments

Security is paramount in Bitcoin investing. Secure your digital wallet with strong passwords and two-factor authentication. Be cautious of phishing scams and only use trusted sources for Bitcoin-related information. Regularly update your wallet software and backup your wallet’s recovery phrase in a secure location.

Regulatory Landscape: Understanding Legal Implications

The regulatory environment for Bitcoin varies by country and can significantly impact your investment. Stay informed about your local regulations regarding cryptocurrency trading and taxation. Regulatory shifts can affect Bitcoin’s price and your legal obligations as an investor.

Long-term vs Short-term Investment: Assessing Time Horizons

Consider your investment timeframe. A long-term investment approach might suit those who believe in Bitcoin’s future potential, while a short-term approach could appeal to those looking to profit from market fluctuations. Assess your financial goals and risk tolerance to determine the right approach for you.

Diversification: Balancing Your Portfolio with Bitcoin

Incorporating Bitcoin into a diversified portfolio can mitigate risk. Bitcoin’s price movements often differ from traditional assets like stocks or bonds, which can provide portfolio diversification benefits. However, diversify wisely, balancing Bitcoin with other investments to manage overall risk.

The Future of Bitcoin Investing

Emerging Trends in Bitcoin Investment

The investment landscape for Bitcoin is continuously evolving, marked by the emergence of new trends. Currently, we are witnessing an increased institutional interest in Bitcoin, suggesting a growing acceptance of this digital currency as a legitimate asset class. Technological advancements like the Lightning Network are poised to solve scalability issues, potentially increasing Bitcoin’s utility for everyday transactions. Moreover, the trend towards decentralized finance (DeFi) is opening new avenues for Bitcoin to be used in various financial services, broadening its application beyond mere investment.

Challenges and Opportunities in Bitcoin Investing

Investing in Bitcoin presents a unique set of challenges and opportunities. Volatility remains a significant concern, with price fluctuations posing both risks and opportunities for high returns. Regulatory uncertainty continues to be a challenge, though it also offers the potential for positive developments as governments and financial institutions evolve to accommodate cryptocurrencies. Security concerns, particularly in the storage and transfer of Bitcoin, present another challenge that demands continuous innovation in cybersecurity measures.

Bitcoin’s Role in Modern Portfolios

Bitcoin is increasingly becoming a staple in modern investment portfolios. Its low correlation with traditional asset classes like stocks and bonds makes it an attractive option for portfolio diversification. For investors seeking exposure to new asset classes in the digital age, Bitcoin offers an alternative investment that complements traditional investments, potentially reducing overall portfolio risk and enhancing returns.

Some FAQs Answered On The Relevant Topic

How Does Bitcoin Compare to Traditional Investments?

Bitcoin differs significantly from traditional investments like stocks and bonds. It is known for its high volatility and independence from traditional financial markets, making it an attractive diversification tool. Unlike stocks, which represent ownership in a company, Bitcoin is a decentralized digital asset not tied to any entity or government.

What Are the Tax Implications of Investing in Bitcoin?

The tax implications of investing in Bitcoin vary by country. In many jurisdictions, Bitcoin is treated as property for tax purposes, meaning that capital gains tax applies to any profits made from selling or trading Bitcoin. Investors should consult with a tax professional to understand the specific tax regulations regarding Bitcoin in their region.

How Can Investors Minimize Risks When Investing in Bitcoin?

Investors can minimize risks in Bitcoin investing by diversifying their investment portfolio, not investing more than they can afford to lose, staying updated on market trends, and using secure storage methods for their Bitcoin, such as hardware wallets. Practicing proper risk management and having a clear investment strategy are also crucial.

Can Bitcoin Be Used as a Hedge Against Inflation?

Bitcoin is increasingly being considered as a hedge against inflation. Its capped supply of 21 million coins contrasts with fiat currencies that can be printed unlimitedly, potentially leading to inflation. This scarcity is one of the reasons why some investors view Bitcoin as a digital counterpart to gold, a traditional inflation hedge.

In conclusion, investing in Bitcoin represents a foray into the future of finance, embodying both the challenges and opportunities of the digital age. From its evolving role in investment portfolios to its potential as an inflation hedge, Bitcoin is redefining the landscape of digital currency investments. As the market continues to mature, strategic and informed investment in Bitcoin could offer significant rewards, making it an essential consideration for the modern investor. This guide underscores the importance of staying abreast of market trends, understanding the risks, and adopting a strategic approach to investing in Bitcoin.

Eric Dalius is The Executive Chairman of MuzicSwipe, a music and content discovery platform designed to maximize artist discovery and optimize fan relationships. Outside of MuzicSwipe, he hosts the weekly podcast “FULLSPEED,” which highlights conversations with accomplished entrepreneurs. Eric is also committed to supporting education through the “Eric Dalius Foundation,” offering four scholarships to US students. Keep up with Eric on Twitter,YouTube, Facebook, LinkedIn, Instagram, and Entrepreneur.com.